Greatoo: Make initial Achievement in Industrial Robots, with Expected Growth in the Future

Createtime:2016-04-21Source:UnknownEdit:AdminGreatoo: Make initial Achievement in Industrial Robots, with Expected Growth in the Future

Introduction

Greatoo manages to develop high-end intelligent equipment manufacturing industries and has made initial achievements in industrial robots. Its growth in the future is worthy of expectation.

The main points of investment

Conclusion: the market regards the company as a tire and abrasive tool manufacturing industries. We think that the company manages to develop high-end intelligent equipment manufacturing industries and has already made initial achievements in industrial robots. We can expect the company’s growth in the future. The company’s traditional industries is not as good as the expectation, decreasing the EPS of 2016 to 2018 to 0.24(-0.23)、0.29(-0.33)、0.33 yuan. With the consideration of the substantial decrease of the market value, the company revises down the target price to 19.2 yuan, 'increase' compared with 80 times of PE.

Cooperating with Greatness Fund, Greatoo has strong determination to expand its industrial robots. ① Cooperating with Greatness Fund, Greatoo continues to promote its development of intelligent robots and shows a strong determination to purchase intelligent robots. ② With greater policy support, the acceleration of localizing industrial robots is worthy of expectation. ③ The company has made initial achievements in industrial robots and its growth in the future can be expected. The company has finished producing scales of 4-degree and 6-degree light and heavy robots and made important breakthrough in localizing and producing high precision RV reducers. In 2015, the company’s revenue of industrial robots reached 58 million yuan and took the proportion of 0.1%、0.6%、6.0% of the annual revenue from 2013 to 2015, which showed a rapid increase.

By indirectly holding the stocks of Germany OPS, the company accelerates its intelligent manufacturing. ① Greatoo indirectly held 43.6% of Germany OPS, which helped the company accelerate its development of industrial robots and intelligent equipment. ② OPS’mian products are the complete sets of automatic equipment, high-end numerical controlled electric discharge machine and high-end vertical machining centers; OPS has many high-end customers, including BMW, VW, Ford, Visteon, Boer, Belrose, Siemens, Nypro, Ace Mold and Zongxin Mold. ③ In 2015, OPS’s revenue is 327 million yuan and net margin is 25 million yuan. The consolidated statements will promote its performance.

Catalyze: the extension of intelligent robots

The main risks: the risk of investment in foreign countries, the risk of relying on tire industries, the risk of robots’ development lower than expectation

1. Key logic of investment

Conclusion: the market regards the company as a tire and abrasive tool manufacturing industries. We think that the company manages to develop high-end intelligent equipment manufacturing industries and has already made initial achievements in industrial robots. We can expect the company’s growth in the future. The company’s traditional industries is not as good as the expectation, decreasing the EPS of 2016 to 2018 to 0.24(-0.23)、0.29(-0.33)、0.33 yuan. With the consideration of the substantial decrease of the market value, the company revises down the target price to 19.2 yuan, 'increase' compared with 80 times of PE.

Cooperating with Greatness Fund, Greatoo has strong determination to expand its industrial robots. ① Cooperating with Greatness Fund, Greatoo continues to promote its development of intelligent robots and shows a strong determination to purchase intelligent robots. ② With greater policy support, the acceleration of localizing industrial robots is worthy of expectation. ③ The company has made initial achievements in industrial robots and its growth in the future can be expected. The company has finished producing scales of 4-degree and 6-degree light and heavy robots and made important breakthrough in localizing and producing high precision RV reducers. In 2015, the company’s revenue of industrial robots reached 58 million yuan and took the proportion of 0.1%、0.6%、6.0% of the annual revenue from 2013 to 2015, which showed a rapid increase.

By indirectly holding the stocks of Germany OPS, the company accelerates its intelligent manufacturing. ① Greatoo indirectly held 43.6% of Germany OPS, which helped the company accelerate its development of industrial robots and intelligent equipment. ② OPS’mian products are the complete sets of automatic equipment, high-end numerical controlled electric discharge machine and high-end vertical machining centers; OPS has many high-end customers, including BMW, VW, Ford, Visteon, Boer, Belrose, Siemens, Nypro, Ace Mold and Zongxin Mold. ③ In 2015, OPS’s revenue is 327 million yuan and net margin is 25 million yuan. The consolidated statements will promote its performance.

Catalyze: the extension of intelligent robots

The main risks: the risk of investment in foreign countries, the risk of relying on tire industries, the risk of robots’ development lower than expectation

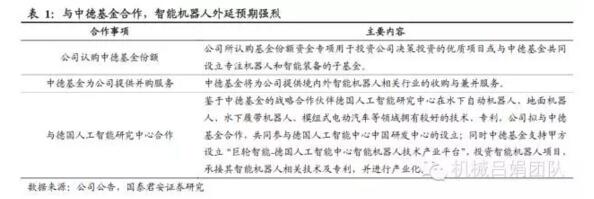

2. Cooperating with Greatness Fund, Greatoo shows strong determination to extend the development of robots.

Cooperating with Greatness Fund, Greatoo promotes the development of robot industry. On April 11, 2016, Greatoo signed Cooperation Contract with Greatness Fund (Zhejiang) High Technology Private Equity Management Ltd. With positive expectations for the development of intelligent robots and intelligent equipment, Greatness’s resources in Germany and the strategic cooperative relationships with German research center of artificial intelligence, Greatoo plans to purchase Greatness high technology investment fund and Greatness will provide the service of mergers and acquisitions for the company.

The company’s plan to purchase Greatness 1 billion fund shows the company’s strong determination to purchase robots. (1) As the company’s platform to invest other intelligent robot industries, Greatness Fund helps the company to gain the necessary recourse for its extension and future improves the company’s current robot industry. (2) At the same time, the cooperation with German artificial intelligence center enables the company to further its exploration of industry 4.0 equipment and develop the complete set of high-end intelligent equipment, which effectively provides supports for the company and contribute to the realization of the company’s overall goal.

3. Initial achievements in industrial robots show expected growth in the future

3.1. With increasing sales of industrial robots, China becomes the biggest market in the world

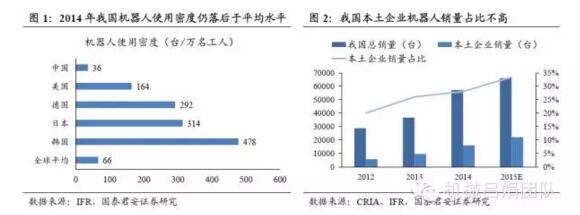

Driven by the policy support and the transformation and upgrading of industries, China has become the biggest market of industrial robots. In March, 2015, Xinhua Net reported that according to the investigation report of International Federation of Robotics, with the growth of 54% in 2014, China has become the country in greatest need of industrial robots. In 2014, the world sold 225, 000 industrial robots, with an increase of 27% compared with that of 2013, and two thirds of robots were sold in Asia. According to the data of CRIA in November, 2015, the market for domestic robots grew stably. In the first half of 2015, 11, 275 industrial robots were sold, with an increase of 76.8 % compared with the same period last year and a growth of 27% compared with the constant figures, which took up 66.5% of the annual sales. It is expected that in 2015, the annual sales of domestic industrial robots will be over 22, 000, increasing by 30% compared with the 2014.

However, domestic robots shares a small part of the market although the demand is high. What’s more, China has a weak research and development ability of key components. In 2013, China has become the biggest market of industrial robots in the world, and the sales of industrial robots in Chinese market increased by 54% in 2015, reaching the number of 56, 000. However, Chinese suppliers only sold 16, 000 industrial robots, with a percent of about 28%, the rest from foreign suppliers.

3.2. With stronger policy support, the growth of domestic robots is worthy of expectation

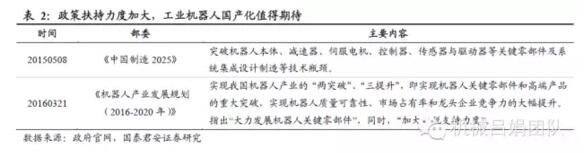

With stronger policy support, the growth of domestic robots is worthy of expectation. In May 8, 2015, the State Council issued Made in China 2025, indicating that numerically-controlled machine tools and industrial robots are the two areas that need breakthrough most and “breakthroughs should be made in the body of robots, reducers, servo motors, controllers, sensors and actuators.” On April 6, 2015, the website of the Ministry of Industry and Information Technology announced that on March 21, 2015, the Ministry of Industry and Information Technology, State Development and Reform Commission and the Ministry of Finance issued “The Development Plan of Industrial Robots (2016-2020)” to lead the healthy and sustainable development of robotic industries in our country and realize the goal of “two breakthroughs” and “three growth”, that is making breakthrough in the core components of robots and high end products and making growth in the reliability of the quality of robots, the market share and the competitiveness of leading enterprises. Besides, the State Council declared that “China should strive to develop the core components of robots” and “increase financial support.”

With the support of policy, catalysts driving the development of robotic industries will continue. 2016 is the first year of the Five-year Plan. The five-year development plan of robot industries will strengthen the confidence of the market in the development of robot industries. The development plan puts forward six measures, including increasing financial support and widening the channels of investment and financing; we thinks that increasing financial support will drive the development of the industries of robots and relevant core components. Besides, we expect that in the future, local governments will also come up with development plans of robots industries. With more and more policy support, catalysts driving the development of robotic industries will continue.

3.3. Initial achievements in industrial robots show expected growth in the future

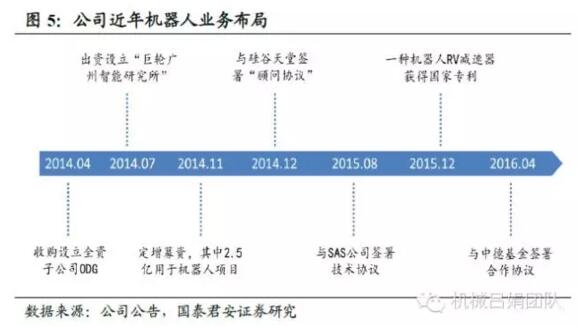

The market regards the company as a tire and abrasive tool manufacturing industries. We think that the company manages to develop high-end intelligent equipment manufacturing industries and has already made initial achievements in industrial robots. We can expect the company’s growth in the future. In 2015, the company’s revenue of industrial robots reached 58 million yuan and took the proportion of 0.1%、0.6%、6.0% of the annual revenue from 2013 to 2015, which showed a rapid increase.

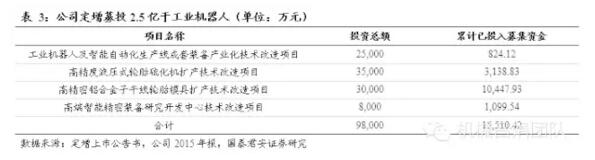

1 billion yuan drives the company’s second development. In 2014, the company privately issued shares worth 1 billion yuan, collecting 250 million yuan for industrial robots. The company began the development of its robot industry by targeting at tire industries and machine processing industries which the company is familiar with and has its customers. Besides, the company has already invented many six-degree light robots and four-degree heavy robots and made crucial breakthrough in high precision RV reducers, the core components of robots. Capacily will be achieved after the implementation of the project: ① 50 sets of non-standardized intelligent automatic production line equipment for tire industries each year; ②30 sets of standardized intelligent automatic production line equipment for machine processing industries each year.

The company has produced robots in scale, with four-degree heavy robots and six-degree light robots weighting of10kg、20kg、50kg、100kg、150kg、200kg、300kg. The first automatic production line of industrial robots in China which was designed by the company for Zhongce Rubber Ltd has been applied into use, which has become a typical example for tire industries to be the first kind of industries using the automatic production line of industrial robots. We think that with experiences in industrial robots, in 2015, the company has already made initial achievements in industrial robots. We can expect the company’s growth in the future.

4. The company indirectly holds the stocks of Germany OPS, accelerating the development of intelligent manufacturing

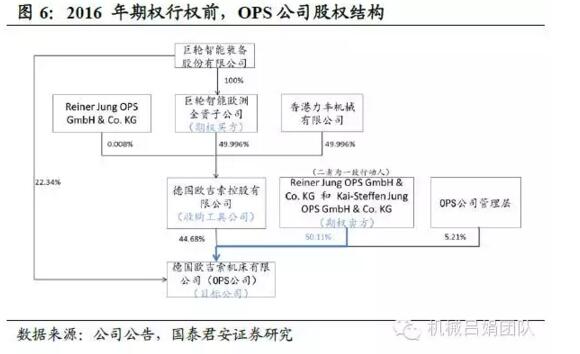

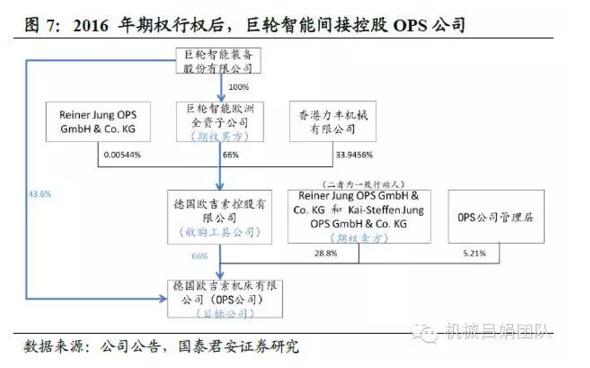

The company indirectly holds the stocks of Germany OPS, accelerating the development of industrial robots and intelligent equipment. On April 5, 2016, the company announced that it will use its share option purchased on October 15, 2011, buying 23, 550 stocks of OPS by OPS Holding, 21.32% of the whole stocks of OPS. After that, Greatoo will indirectly hold 43.6% of all the stocks of OPS.

OPS is mainly engaged in researching, manufacturing and selling the complete sets of automatic equipment and relevant technologies, high-end numerical controlled electric discharge machine, high-end vertical machining centers, with high brand value and reputation in Europe. OPS has many high-end customers, including BMW, VW, Ford, Visteon, Boer, Belrose, Siemens, Nypro, Ace Mold and Zongxin Mold.

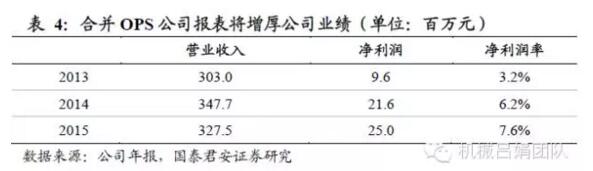

By indirectly holding the stocks of OPS, the company’s performance will be increased by the consolidated statements. Since the investment in the target company, Greatoo has substantially improved its performance, with obvious increasing profitability. In 2015, OPS’s revenue is 327 million yuan and net margin is 25 million yuan, with a rate of profit of 7.6%. The consolidated statements will improve the company’s performance to some extent.

The company will take advantage of OPS and robot industry to expand the application of 3C and automobile industries so as to seize more growth. The company takes advantage of OPS’s superior processing technology of 3C industry and gradually comes up with the automatic processing solution of 3C industry which combines the processing centers of machine tools and robots’ feeding and blanking, promoting the sales in 3C industry. At present, besides for tires and 3C, the company expands its application area of intelligent equipment to auto parts. The company designed and produced an automatic production line of car beams for Minth Group, an international manufacturer of auto parts.

5. Prediction of profits and investment suggestions

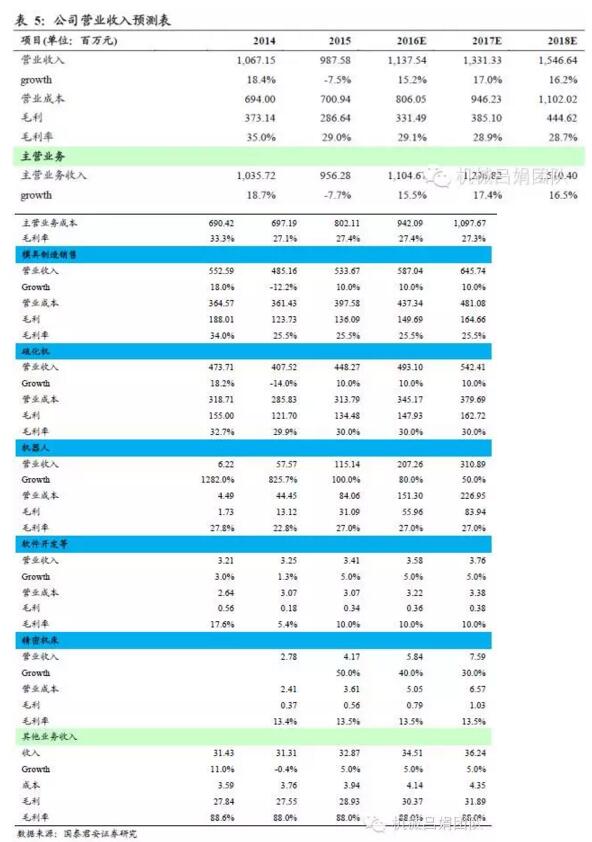

In terms of the current industries, the company’s growth rate is 15.2%、17.0%、16.2% from 2016 to 2018. Affected by the changes of international market and America’s “Double Anti” to Chinese tires, the growth of tire mold industries is slow. If the car ownership and the sales of cars in our country increase, the growth rate of the sales of tires and curing presses will maintain 10% per year and the gross profit rate will be 25.5% and 30.0%. Robotic business will enjoy rapid growth, with expected growth rates of 100%, 80%, 50% in 2016, 2017 and 2018. If the influences of OPS’ s consolidated statements are not considered, the growth rates of precision machine tools will be 50%, 40%, 30% in 2016, 2017 and 2018.

In terms of the present main industries, EPS from 2016 to 2018 is expected to be 0.24, 0.29 and 0.33 yuan. With 43.36% of the stocks of OPS, EPS from 2016 to 2018 will be 0.26, 0.31 and 0.35 yuan with the consolidated statements. With the EPS of 0.24 yuan in 2016 before the consolidated statements, the company is given 80 times of PE corresponding to the target price of 19.2 yuan, with the grade of increase.

6、Risks

6.1. The risk of investment in foreign countries

In recent years, the company accelerates its international development. The company has established its subsidiaries, India Greatoo, International Greatoo, HK Greatoo, European Greatoo, ODG, America Greatoo, merged America NE company. Indirectly held the stocks of German OPS and cooperated with Greatness Fund in order to find overseas projects related to the company. The complex economic environment in foreign countries and huge differences in laws, policy systems and commercial environment between China and foreign countries bring some risks to the overseas subsidiaries.

6.2. The risk of relying on tire industries,

The company’s main products are radial tire molds and hydraulic curing presses which are two kinds of necessary equipment in the production of tires, and its customs are mainly tire manufacturing industries. The demand of the company’s products is closely related to the prosperity of tire industries, tire products adjustment and the development of car industries. What’s more, the development of robot industries relies on the fixed assets expenditure of tire manufacturing industries. The cyclic adjustment of tire industries will have some influence on the demand of radial tire molds, hydraulic curing presses and industrial robots, which means that the company is confronted with the risk of relying on some industries.

6.3. The risk of robots’ development lower than expectation

The demand for robots in domestic market still maintains stable growth. However, the fixed assets expenditure of downstream firms is cyclic, which may fluctuate the demand for robots. What’s more, if the company’s research and promotion of robots fail to meet the expectation, the company’s performance will be influenced.